Camden County Lawsuit Loans – Get Help

Camden County lawsuit loans allow plaintiffs to meet their obligations while they fight for their rights. These transactions level the financial playing field between plaintiffs and deep pocketed insurance companies by allowing plaintiffs the ability to wait out the legal process.

Camden County Interesting Facts

Camden County is located in southwestern New Jersey and across the Delaware River from Philadelphia. It is the state’s 9th most populated county with over a half of million residents according to the 2020 Census.

Consisting of urban, suburban, farmland and pineland areas, Camden County’s easternmost boundary lies at the New Jersey Pinelands National Reserve. Its county seat, Camden is a densely populated city directly across the Delaware from Philadelphia and connected by the Walt Whitman, Ben Franklin and Betsy Ross bridges. The city of Camden is home to various county offices and the Superior Court of New Jersey, Camden County. The United States District Court for the District of New Jersey is also located in Camden, NJ.

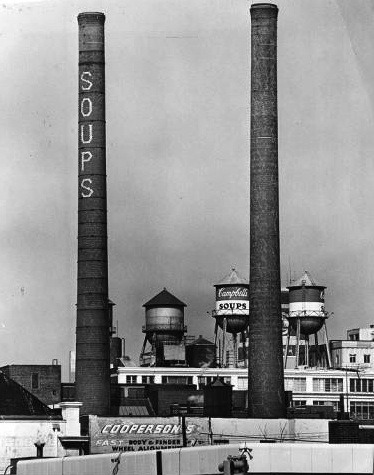

Over 150 years ago, Joseph Campbell, a fruit merchant, and Abraham Anderson, an icebox manufacturer, formed the business that became Campbell Soup Company. They opened their first plant in Camden, NJ in 1869.

Camden blossomed into an industrial city at the turn of the century (1900). It became home to the Victor Talking Machine Company, and thereafter to its successor RCA Victor, the world’s largest manufacturer of phonographs and phonograph records at the time. New York Shipbuilding was also located in Camden which was the most productive shipyard in the world during World War II.

Camden County is also home to various educational institutes including:

- Rutgers University – Camden

- Rutgers University Law School – Camden

- Cooper Medical School of Rowan University

Also within Camden County is Pine Valley Golf Club. Known throughout the world as one of the greatest golf courses in the world, Pine Valley Golf Club is located in the Borough of Pine Hill and is rated the best golf course in the United States by Golf Digest.

Camden County Accident Lawsuits

The sheer number of Camden County residents and economic travel in the area leads to more dangerous roadways and a higher number of accidents. For example, NJ Department of Transportation studies report that Camden County had over 11,000 reported crashes in 2020 and almost 15,000 in 2019. The drop off was attributed to the decrease in economic and other activity due to the Covid-19 response. Further, over 2,800 reported injuries in 2020, up almost a thousand per year from 2019. Also, large and densely populated areas see more slip and fall and premises liability type negligence claims than lesser populated regions.

Accidents can result in serious injuries and inevitably result in lawsuits where injured parties seek compensation for their conditions. The legal process takes time however, as the wheels of justice turn slowly. Plaintiffs can expect their cases to take years before they are resolved in Camden County.

It is fortunate injured plaintiffs can receive compensation for their injuries. What is unfortunate is that many are unable to work leaving them in financial straights while their cases are litigated. Of course, the insurance companies which represent the defendants in these actions know this situation well. They often use a plaintiff’s financial condition as leverage in forcing plaintiffs to accept low-ball settlement offers simply to keep their heads above water financially.

Camden County lawsuit loans attempt to remedy this situation.

What is a Camden County Lawsuit Loan?

A Camden County lawsuit loan is a financial transaction where “lawsuit lenders” advance money to plaintiffs in return for a portion of the future settlement, if any. The transaction is “non-recourse” because the lawsuit funding company cannot pursue the plaintiff personally for repayment. Unlike traditional loans, lawsuit loans are a partial “sale” of the future settlement. This means if you don’t win your case, you do not repay the advance.

This unique nature of lawsuit loans means the applicant’s credit is unimportant to the underwriting process. Neither are employment status or current assets since the lawsuit itself must be the source of repayment.

Lawsuit funding companies advance money prior to settlement so plaintiffs can pay for living and other expenses while they wait for the case to settle. Other uses for settlement advances might include paying for:

- past debts

- surgical and other medical treatment

- mortgage or rent

- car payments or other transportation costs

- and more. . .

In truth, lawsuit loans can be used in any way plaintiffs see fit. It’s their settlement money after all, plaintiffs are just getting it prior to settlement.

To learn more about lawsuit loans, visit our frequently asked questions page.

If You Have Any Questions, Call 888-964-2224

WE ARE HERE TO HELP YOU!

Camden County, NJ Towns and Cities

Camden County consists of 36 municipalities. Camden County lawsuit loans are available in the following cities:

- Audubon

- Audubon Park

- Barrington

- Bellmawr

- Berlin borough

- Berlin township

- Brooklawn

- Camden

- Cherry Hill

- Chesilhurst

- Clementon

- Collingswood

- Gibbsboro

- Gloucester township

- Gloucester City

- Haddon

- Haddon Heights

- Haddonfield

- Hi-Nella

- Laurel Springs

- Lawnside

- Lindenwold

- Magnolia

- Merchantville

- Mount Ephraim

- Oaklyn borough

- Pennsauken

- Pine Hill

- Pine Valley

- Runnemede

- Somerdale

- Stratford

- Tavistock

- Voorhees

- Waterford

- Winslow

- Woodlynne

Getting Started with Camden County Lawsuit Loans

To be eligible for Camden County lawsuit loans you must:

- have a pending claim

- be over the age of 18 and

- be represented by an attorney

The lawsuit funding process is easy. To get started, simply contact us. Once you apply or call, we will contact you immediately and begin the process. You can then relax and allow Fair Rate Funding to work for you. After we speak to you about your options, we contact your attorney to discuss the details of your case. Once approved, you sign and return the funding agreement. When received, you receive your lawsuit loan. It’s really that simple!

If you were involved in an accident or civil case, have an attorney and want to get cash prior to settlement, Fair Rate Funding can help you! Civil lawsuits often cause both physical and financial hardship.

When financial strain forces you to consider accepting less than you deserve, don’t wait – call Fair Rate and let us help you.

Apply Now or Call us to get started. We are here to help. We are at your service.